Is the Wise Card Worth It for Travel in 2025? An Honest Review

Last Updated on November 14, 2025 by Kay

This post may contain affiliate links, meaning I may earn a small commission on any purchases through those links at zero additional cost to you. Whatever I make goes to keeping this website running and I am forever grateful for the support. See my Privacy Policy for more information.

Nowadays, there are tons of ways to pay for things when traveling abroad, such as apps, digital wallets, and credit cards galore, so I rolled my eyes when my husband told me about the Wise Card. I wasn’t interested in making yet another debit card and contributing to my already bulging wallet.

At his insistence, though, I made a Wise card and used it while I was traveling abroad. And you know what? I ended up being pleasantly surprised by how cost-effective using a Wise card was.

In this article, I’ll share everything you need to know about Wise, as well as my personal experience using the card. Hopefully, by the end, you’ll have an idea about whether it’s worth it for you to use this card for your next adventure.

Table of Contents

What is Wise?

Wise (originally known as TransferWise) is a financial service company that helps people send, hold, and convert multiple currencies.

With a Wise account, you can:

Hold and convert over 40 currencies

Send money internationally

Receive payments in multiple currencies (like USD, GBP, EUR, JPY)

Get a debit card to spend from your balance

This is probably why Wise is particularly attractive for expats, such as those living in Japan, and a great card to use when traveling abroad.

What is the Wise Card?

The Wise card is a physical or virtual (Apple Pay / Google Pay, etc), debit card offered by Wise that’s linked to your Wise multi-currency account.

You can use the physical card to make purchases in person at shops worldwide or online, while the virtual debit card can only be used online.

Note that the Wise card is a debit card, not a credit card, so there’s no borrowing money, and you can only spend what you’ve deposited into your account. So this means you don’t have to pay any interest.

If you hold the currency you spend in your Wise account (for instance, USD in your account and you’re shopping in America), then using the Wise card in that currency means no extra conversion fee, you just draw from your existing balance, which is pretty nice.

However, if you don’t hold a particular country’s local currency in your account while traveling there, Wise will convert it for you when you make a payment at a competitive rate. This rate is especially competitive in comparison to major credit card companies like Visa and MasterCard, enough that we forgo our MasterCard points and use Wise instead when traveling abroad.

Wise Card Pros and Cons

For those wondering what the benefits of using a Wise card are versus the cons, here’s a quick look.

Pros of Using the Wise Card Abroad

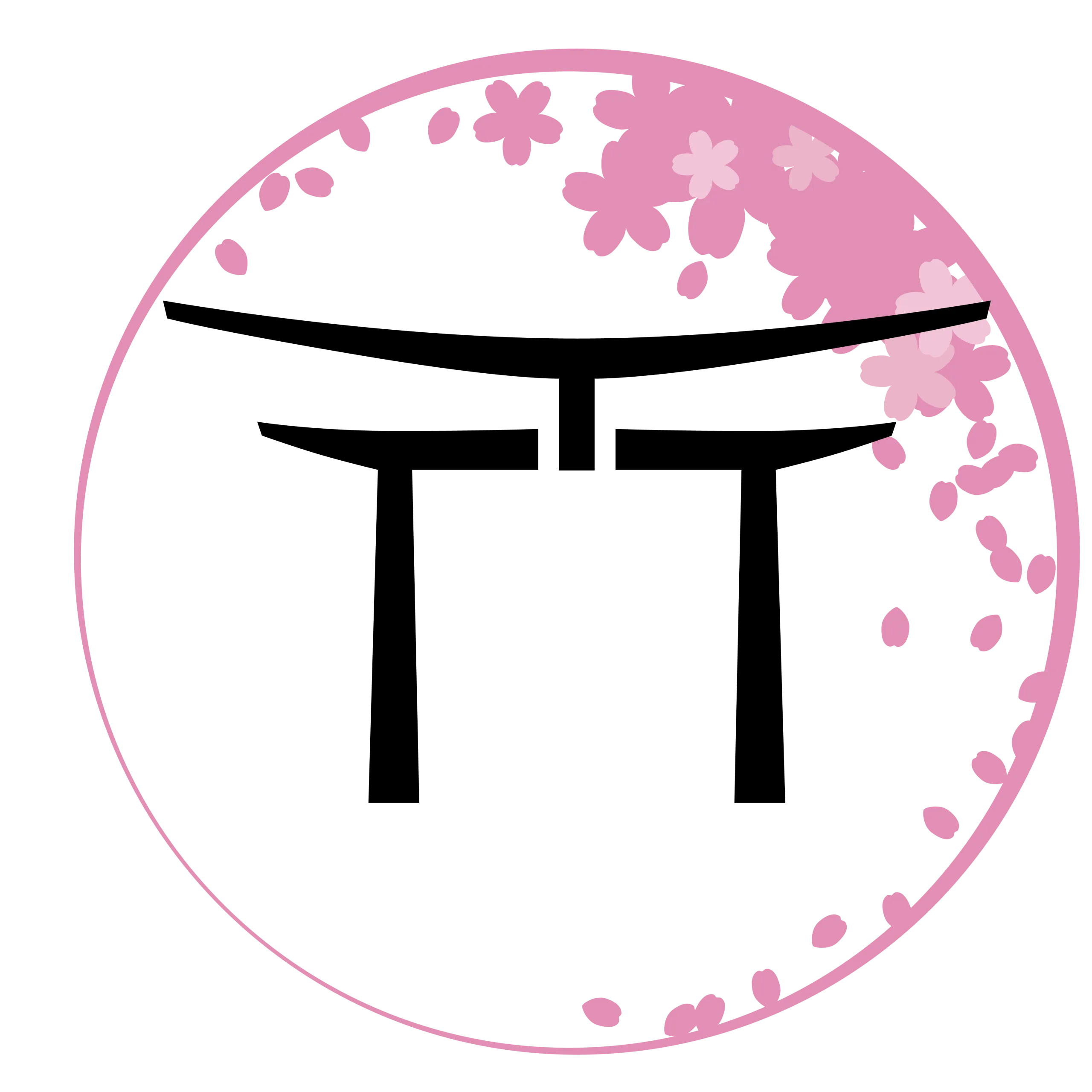

1. Offers better currency conversion rates

Wise uses the mid-market exchange rate and charges a low fee that’s often cheaper than what Visa or Mastercard charges for foreign transactions. This means savings of around 4 to 5% by using the Wise card at a merchant.

Withdrawing money using a Wise card at an ATM also usually has a better rate than using a credit card.

In my case, I saved around 1,100 JPY on a single transaction in Hong Kong compared to my Japanese credit card. That adds up quickly on a long trip.

You can see Wise’s currency conversion rates here.

2. Supports many currencies

You can hold and convert between 40+ currencies in your account, including JPY, USD, AUD, EUR, GBP, SGD, and CAD.

This makes it easy to set aside money for future trips, avoid unnecessary conversions, and pay in the local currency when booking hotels, flights, or shopping online.

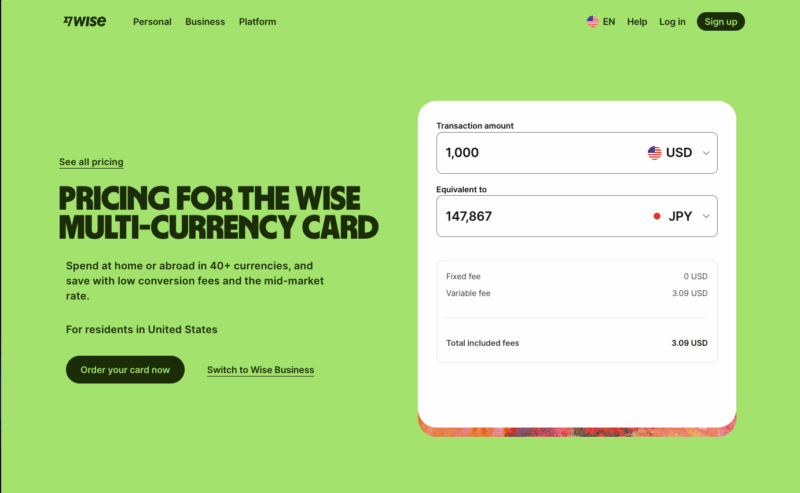

3. Easy tracking and top-ups

The Wise app is one of the best parts about using a Wise card. It tracks your spending in real time, allows you to see your current balance, and shows the current exchange rate.

If you run out of funds in your Wise account, you can easily top it up using the app, and the transfer goes through in moments.

4. Losing your card isn’t the end of the world

Since a Wise card is not a credit card, it’s safer to carry than cash or credit.

For instance, even if you lose your Wise card, whoever finds your card cannot use more than the remaining amount on the card. However, this also means you might end up a bit short when making purchases and will need to top up your card using the app.

Also, it is easy to freeze your card (or unfreeze it if you happen to find it) using the app or online.

Wise Card Cons

1. Minimal fees for a physical card and withdrawals

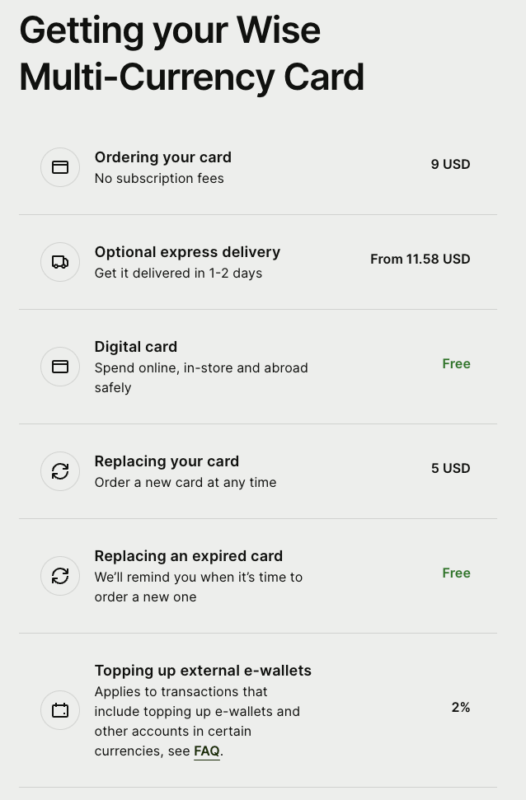

You need to pay a small fee to get your Wise card if you prefer a physical one (which I recommend). Wise’s website has more detailed information about the fees for issuing the card.

You might also be charged ATM withdrawal fees.

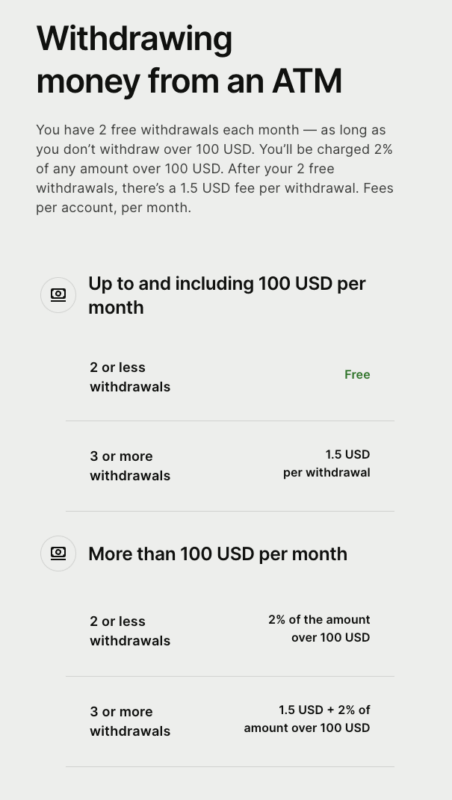

You get up to two free withdrawals a month, depending on the amount you withdraw, before having to pay additional fees per ATM withdrawal. This varies according to the country you live in and your Wise card is registered with (not the country you’re visiting).

For instance, for the US, you can get two free withdrawals a month that are up to 100 USD.

In Japan, you also have two free withdrawals for free but the amount is higher at 30,000 JPY.

In Australia, it goes up to 350 AUD.

3. No in-person application or customer support

Unlike major banks, there is no physical branch that you can visit to apply or get customer support.

All processes and transactions can only be done via the app or online.

4. No credit function or points

As mentioned before, the Wise card does not have a credit card function. You can only use it as a debit card, so if you don’t have the funds in your bank account to transfer over to pay for something, you’re out of luck.

You also don’t get any perks that credit cards offer, such as points or cashback.

How to Get a Wise Card

You can apply for Wise online. Filling out the form is pretty quick and should only take about 10-15 minutes. However, it will take a few days for your application to be processed since your information will need to be verified.

Give yourself about 1-3 weeks to receive your physical card in the mail. (So don’t do this at the last moment before a trip, unless you’re willing to pay for expedited shipping!)

After you get your Wise card, you’ll need to activate it. Then you can add money to it and you’re ready to go!

Once abroad, you can use the Wise card as a debit card in shops that have a debit card machine. You can also use it to withdraw cash from ATMs. (Make sure to remember your pin!)

My Experience Using Wise in Hong Kong

I got the Wise card for a recent trip to Hong Kong, and using it was incredibly easy. In fact, I used it to withdraw money from a local bank’s airport ATM minutes after I landed! Of course, I had deposited about 50,000 JPY into my card before I left Japan.

I also used the Wise card to make purchases at restaurants and stores in Hong Kong just by tapping the card and entering my PIN. I could use the app to track how much I had left on my card, and my balance was short only once. However, this was no problem. I quickly topped it up using the app and was able to complete my payment.

There wasn’t a single retailer that didn’t accept the Wise card, which was great!

I also saved a decent amount during my trip.

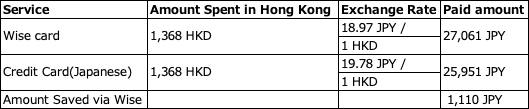

Here’s an example of a transaction I made and my savings by using the Wise card.

I saved about 5% using the Wise card, whereas had I used my MasterCard, I would have only obtained 1% in points. So overall, using the Wise card was more worth it for me.

My Experience Using a Wise Card in Japan

You can easily use a Wise Card in Japan for purchases while traveling in the country.

I live in Japan and I use a Japanese bank account, so I don’t really need to use a Wise Card here. However, I did try out my Wise Card at a convenience store to purchase something and it worked perfectly. All I needed to do was tap it onto the machine.

Debit cards aren’t really a thing in Japan, so you’ll be using the Wise Card as a credit card. When making purchases, just say, “ka-do de“, which means you’ll be paying by (credit) card.

So, Is the Wise Card Worth It for Travel?

Based on my personal experience using the Wise card while I was abroad, I wholeheartedly recommend using it for traveling. I will definitely use it again on my next trip (which I believe is going to be the United States next year!).

Find out more here if you’re interested in trying out Wise for yourself.